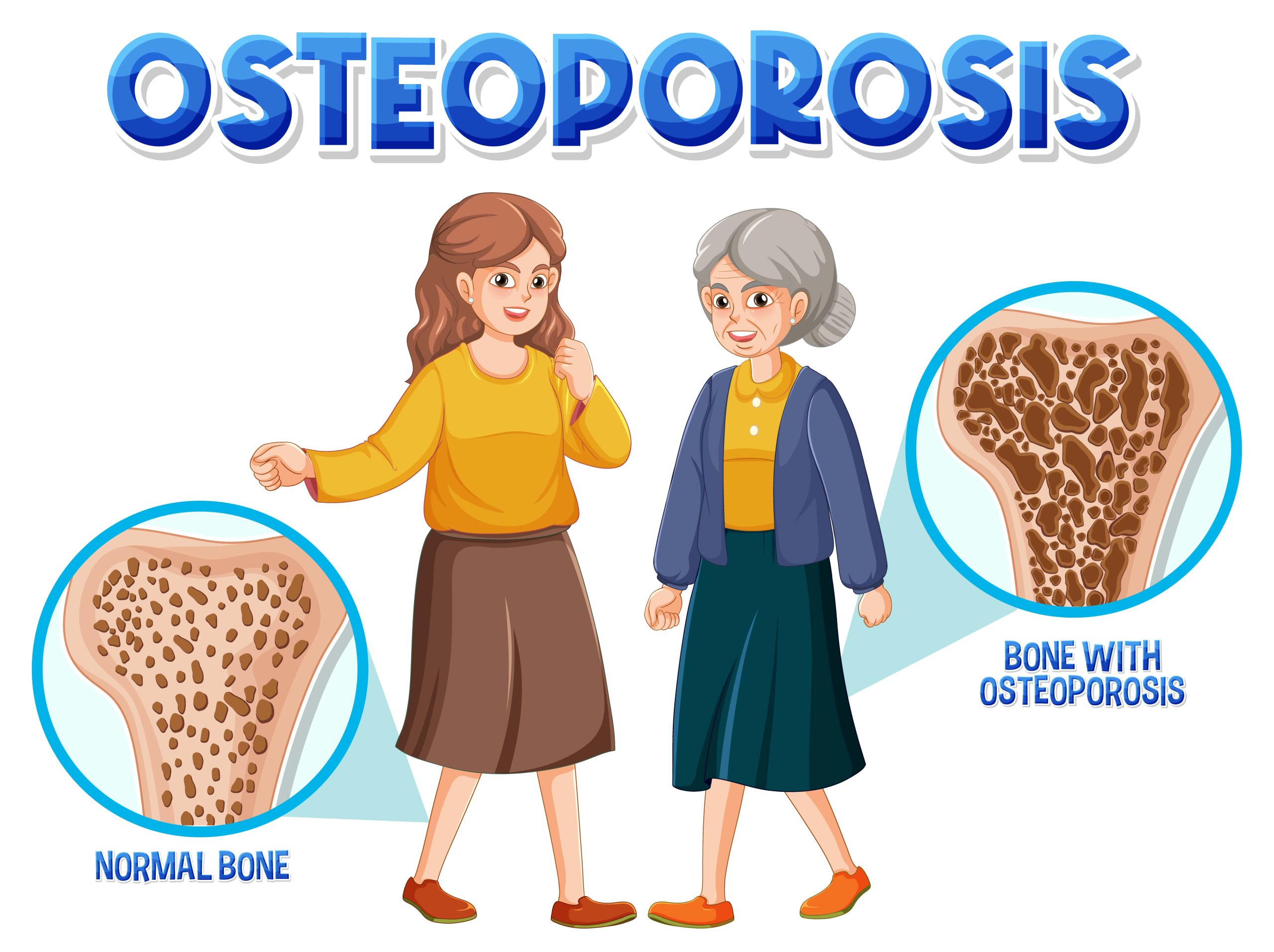

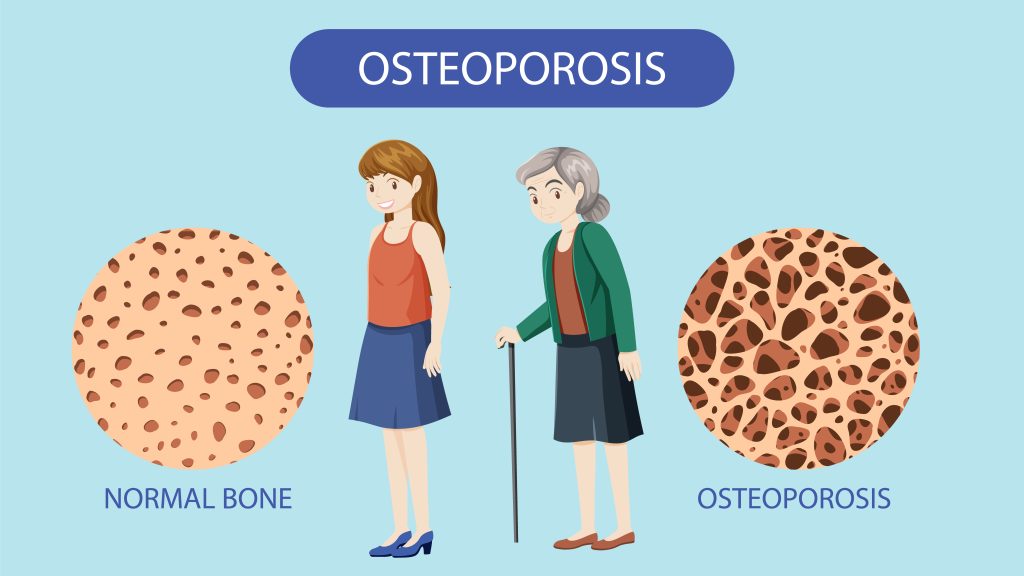

Osteoporosis is a bone disease that causes bones to become thin, weak, and more likely to break. It often develops silently, with many people finding out they have it only after a fracture occurs. Seniors, especially postmenopausal women, are at higher risk. To prevent breaks and monitor bone health, doctors often recommend bone density screening for older patients. For anyone on Medicare, it’s important to know which osteoporosis services are covered – from screenings and tests to medications and therapy – and what costs you can expect.

Medicare Basics: Parts and Plans

Medicare is the federal health insurance for people 65 and older (or with certain disabilities). It has different parts for various services:

- Part A (Hospital Insurance) covers inpatient hospital care, skilled nursing facility stays, and some home health care.

- Part B (Medical Insurance) covers outpatient care: doctor visits, lab tests, medical equipment, and preventive services.

- Part D is the prescription drug plan (run by private insurers) that covers most medications, including many osteoporosis drugs.

- Part C (Medicare Advantage) are private plans that bundle Part A, B, and often D into one plan. These plans must cover at least what Original Medicare covers, but may have networks and different cost structures.

Original Medicare (Parts A & B, plus optional Part D) generally lets you see any provider that accepts Medicare nationwide. Medicare Advantage plans (Part C) are offered by private insurers; many have $0 monthly plan premiums (on top of the Part B premium) and often include Part D drug coverage. Advantage plans also include an annual limit on your out-of-pocket costs, unlike Original Medicare.

Key Medicare terms: You pay a premium for Part B (about $185/month in 2025) and a yearly deductible ($257 in 2025) before Part B (outpatient) coverage kicks in. After that, you generally pay 20% coinsurance for most Part B services. Part A has a deductible of $1,676 in 2025. Prescription drugs under Part D have their own deductible and copays that vary by plan. Many people buy a Medigap (Supplement) policy to help with the 20% coinsurance gaps, but Medigap is only for Original Medicare, not needed if you join a Medicare Advantage plan.

Bone Density Tests and Osteoporosis Screenings

Screening for osteoporosis usually means a bone density test (DEXA scan) that measures bone strength. Medicare Part B covers a bone density test once every 24 months (every 2 years) if you meet certain risk conditions. For example, coverage applies if you are a woman with signs of hormone-related bone loss, have X-ray evidence of osteoporosis (or prior fractures), are starting long-term steroid treatment, have certain hormonal disorders, or if your doctor needs to see how well your osteoporosis medication is working. If you qualify and go to a Medicare-approved testing center, Medicare pays the entire cost of the bone density test – you pay nothing (as long as the provider accepts Medicare).

Medicare Advantage plans must cover the same osteoporosis screening. If you have a Medicare Advantage plan (Part C), you should still be eligible for the bone density test at least every 2 years. However, Advantage plans typically have networks of providers. To get full coverage, you may need to use a doctor or testing center in your plan’s network. Some plans might have a small copay or coinsurance for the test. It’s important to check your plan’s rules – for example, some Advantage plans require a prior authorization or a referral from your primary care doctor.

Osteoporosis Medications and Injections

Treating osteoporosis often involves medications that build bone or slow bone loss. These can be pills, infusions, or injections. How Medicare covers them depends on how the drug is given:

- Oral medications and self-injected drugs: These are covered by Medicare Part D (the drug plan) or by Medicare Advantage plans that include drug coverage. Common osteoporosis drugs include bisphosphonate pills like alendronate (Fosamax), risedronate, ibandronate, and raloxifene. Even stronger therapies like Forteo or calcium regulators that patients inject themselves at home generally fall under Part D. Your Part D plan will have a formulary showing which osteoporosis drugs are covered and at what cost. You pay a portion of the drug cost according to your plan.

- Injected osteoporosis treatments by a health provider: Some drugs, like Prolia, may require a healthcare provider or nurse to give the shot. Medicare Part B covers these in-office or in-home injections if you meet strict conditions. Specifically, Original Medicare will pay for osteoporosis injectables and the home health nurse visit under Part A/B only if you: have a doctor-certified postmenopausal osteoporosis diagnosis with a related bone fracture, meet Medicare’s home health requirements, and cannot self-inject the medication. In those cases, after you hit the Part B deductible, Medicare pays 80% of the cost of the drug and administration, and you pay the remaining 20%. Importantly, Medicare pays nothing for the nurse’s home visit when injecting the drug.

If an injected osteoporosis drug is given in a hospital inpatient stay (Part A), then Part A covers it as part of your stay.

Medicare Advantage plans that include Part D will cover these prescription osteoporosis drugs and injections too. An Advantage plan must cover the same drugs, but it may place them on different tiers or require prior approval. If Prolia is covered under Part B in Original Medicare, a Medicare Advantage plan will cover it too, generally with similar 20% coinsurance. However, Advantage plans might require in-network doctors or pharmacies and could have additional step-therapy rules.

Physical Therapy and Other Services

Osteoporosis care often involves rehabilitation and therapy after fractures or falls. Medicare Part B covers medically necessary outpatient physical therapy, occupational therapy, and related services. For example, if you break a hip and need PT to learn how to walk again, Part B will cover those therapy sessions (you pay 20% coinsurance after the deductible). Part A covers rehabilitation if you are admitted to a hospital or skilled nursing facility after surgery. There is no yearly dollar limit on therapy under Medicare – as long as the doctor orders it as medically necessary for your recovery, it’s covered.

Medicare Advantage plans also cover therapy services, but usually with fixed copays per visit instead of a percentage. Some Advantage plans even include extra wellness programs that help with bone health, like gym memberships or fall prevention classes. Always verify whether the therapist is in your plan’s network.

Comparing Coverage: Original Medicare vs. Medicare Advantage

Choosing between Original Medicare and a Medicare Advantage (Part C) plan involves trade-offs. The table below compares how each handles osteoporosis care, costs, and benefits:

| Coverage/Feature | Original Medicare (Parts A & B, plus Part D) | Medicare Advantage (Part C) |

|---|---|---|

| Bone Density Tests | Covered under Part B every 24 months if you have risk factors. Test is fully covered (no copay) if done by a Medicare provider. | Plan must cover the same tests. You may need to use an in-network facility. |

| Osteoporosis Medications | Oral medications covered under Part D. Injectable drugs (e.g. Prolia) covered under Part B if criteria are met. | Covered under Part D or Part B with similar conditions and rules. |

| Physical Therapy/Rehab | Outpatient PT/OT covered by Part B (20% coinsurance). Inpatient rehab covered by Part A after deductible. | Covered with plan copays. May include additional wellness benefits. |

| Doctors/Hospitals | Use any doctor/hospital that accepts Medicare. | Must use in-network providers (for most plans). |

Conclusion

If you or a loved one is at risk for osteoporosis, Medicare provides essential coverage for screening, treatment, and therapy. Bone density tests are covered every 2 years if you meet risk criteria, and they’re fully covered with no out-of-pocket costs in most cases. Medications are covered through either Part D or Part B, depending on how they are administered. And if you’re recovering from a fracture, Medicare helps pay for physical therapy to regain strength and mobility. Whether you choose Original Medicare or a Medicare Advantage plan, understanding your benefits can help you manage your bone health with confidence.

At New Mexico Medicare Plan Advisor, we’re here to help you find a plan that fits your needs and budget. If you have questions about your options, coverage, or costs, our licensed agents are ready to assist you. Give us a call today and let’s make sure your Medicare plan works for your health and future.